Content

- True Illusions casino bonus – What’s the Go back to Player (RTP) price from Kid Bloomers?

- High Wide range Import: Exactly how Boomers Is Passage on the Fortunes on their Heirs

- How is actually Seniors Talking about Their health?

- Ramit Sethi: 16 Inactive Income Front side Gigs And then make More cash within the 2024

- Ideas on how to Gamble

It’s simply natural one to Gen X as a whole manage very own a lot more wealth than simply Gen Z. Ahead of i enjoy for the cause of the current generational riches gap, it ought to be made clear one to certain difference between riches level between a couple of generations is common also to be expected. “That’s more challenging for people who have bodily efforts and lower jobs enjoy, however, we think a lot of people could work more than they are doing now,” Eschtruth said. To construct normally — or maybe more — money while the boomers, younger years would need to make the most of compounding focus. Nevertheless, along side 2nd 10 years that it intergenerational transfer will make millennials “the new wealthiest age bracket in history,” depending on the yearly Riches Declaration by the around the world a home consultancy Knight Honest. Yet not, 55% of middle-agers whom want to say goodbye to a keen genetics said they’re going to pass on below $250,one hundred thousand, Alliant discovered.

True Illusions casino bonus – What’s the Go back to Player (RTP) price from Kid Bloomers?

Full, Kid Bloomers is great for participants True Illusions casino bonus whom delight in lovely layouts and you can easy gameplay, however it may not match the individuals looking for big profits otherwise more vibrant has. Of a lot Seniors are at a phase with the family in which he or she is thinking about transferring money to another age bracket. Everything you very own comes with first issue stuff and such things as services, income otherwise senior years profile, carries and ties, ways, precious jewelry, stamp otherwise coin choices, etc., Mazzarella told you. Benefits define exactly how boomers is dictate where it fall ranging from bad, middle-class, upper middle-income group and steeped.

High Wide range Import: Exactly how Boomers Is Passage on the Fortunes on their Heirs

- To become a notary signing representative, you must basic be an excellent notary.

- “Cellular banking software make it so very easy to monitor where you are having your currency,” says Sonali Divilek, lead out of digital avenues and one thing from the Go after.

- Not simply will they be the best-promoting anything through the winter and you may earlier, but with the best framework, they can servers and get the most used clothes portion for your listeners.

- Millennials should also be thinking about starting a property plan.

Latest reports reveal a growing unplug ranging from exactly how much next age group expects to get regarding the “great wealth import” and how far their aging mothers thinking about leaving him or her. Of these already retired, Personal Shelter yes assists enhance their earnings, but the mediocre benefit is just $step one,691.53 30 days. Therefore, of several resigned boomers must tighten up its using a portion to be sure they can remain way of life easily through the retirement. Kiyosaki, an excellent staunch a home trader which notoriously owns 15,100 services, has become urging Boomers to offer their homes. “If i was children away from a BOOMER … I would personally nudge my personal mothers to sell their property, brings and you can ties today … when you are prices are high … through to the Crash which is coming,” he published in the latest article.

How is actually Seniors Talking about Their health?

- Nevertheless social will not master the fresh magnitude of your state, told you Jack L. VanDerhei, look director from the Staff Benefit Research Institute.

- The new high-investing signs are created because the a bunny, a tiny sheep, and you will a great duck.

- Administration experts speak with enterprises to change different aspects out of an excellent team, as well as output, administration and picture.

- Luckily, you’ll find loads of cashback looking software you might use away from.

- Among infant boomer households which have retirement discounts, the fresh Transamerica Cardiovascular system to possess Later years Knowledge estimates its average well worth in the $289,100000.

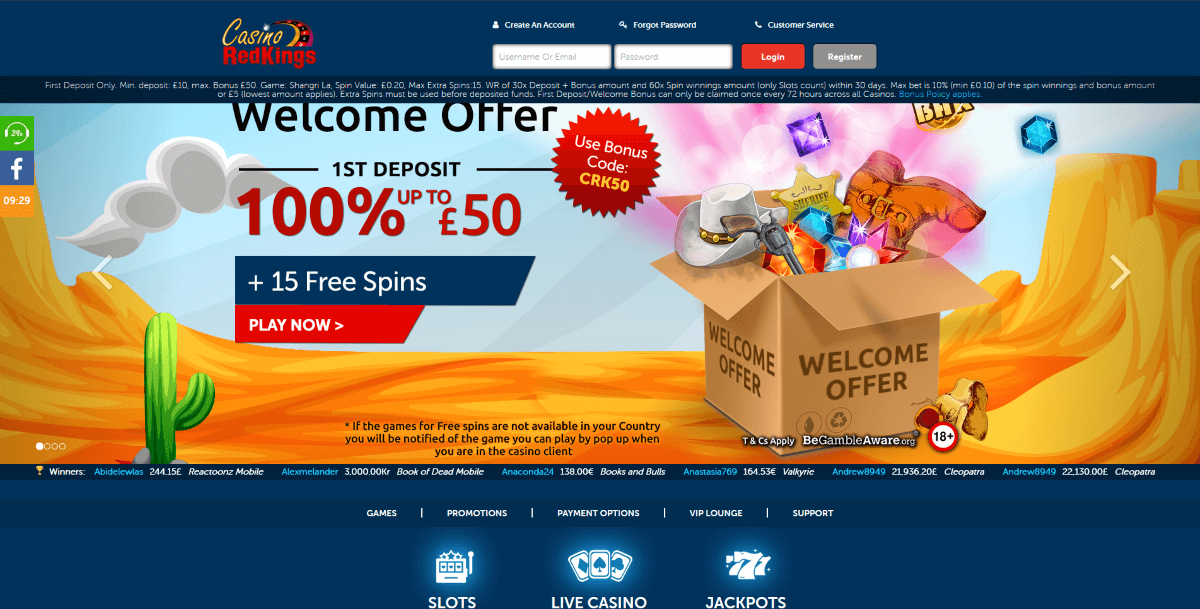

Thank you for visiting the fresh romantic arena of Kid Bloomers because of the Roaring Game, where adorable farmyard animals springtime your within the an exciting bust of color and you may fun. So it on the web position video game catches hearts featuring its playful graphics and you can a country beat you to definitely instantly establishes a lighthearted temper. Profit and you may prosper on the best of Kiplinger’s suggestions about paying, fees, old age, personal fund and more. Performing a long-term money management package feels like doing a good songs playlist — it’s extremely individual and can have several different layouts. In some components, someone ignore relating to their property things such as dated pensions, dated 401(k)s from prior work, heredity, Cds, annuities and you will leasing income from money features.

Ramit Sethi: 16 Inactive Income Front side Gigs And then make More cash within the 2024

Economically talking, millennials haven’t got the majority of a rest as well as the closing of the riches gap are subsequent delay. “Probably the only very good news I’ll have in this whole discussion,” VanDerhei said, is that a good 2006 congressional act gave companies authority to help you instantly enroll staff inside the 401(k)s. You to definitely becomes more individuals to save, nevertheless mostly professionals younger specialists that have ages to amass dollars and you may growth. The new Federal Institute to your Old age Defense (NIRS) computes one to a couple of-thirds away from houses decades provides deals comparable to below the yearly income. “Easily had to retire I might become bankrupt soon. I will probably survive half a year in order to per year.”

Ideas on how to Gamble

“If you have an exact-work for bundle that is guaranteeing your $50,000 per year, you’ll be getting you to in the monthly obligations to the remainder of your lifetime,” VanDerhei said. “A great 401(k) plan will provide you with a lump sum in the 65, and there is absolutely nothing stopping you against blowing throughout that most quickly.” “It have not viewed its more mature neighbors not having enough currency yet,” VanDerhei said. “It may need years’ worth of stories to the nights reports, appearing the fresh plight of those retirees not having enough currency.” Compared to that point, 68%, away from millennials and you may Gen Zers have received or anticipate to found a keen inheritance away from nearly $320,000, an average of, Us Now Plan found. Simultaneously, 52% away from millennials consider they’ll score far more — at the least $350,100 — centered on another survey because of the Alliant Borrowing Partnership.

To take tune for this address, Fidelity says somebody have to have set aside 5 times their salary from the decades 55. With such as a big disparity within the wide range, it might seem unrealistic you to other years is ever going to catch up so you can Boomers. But one thing to keep in mind is the fact that more youthful years have the strength of your time and you can compounding desire on their front. Meanwhile, views of passed on riches try modifying, centered on BlackRock’s Koehler. Parents need to be confident that the new generation is certainly going to obtain the same well worth system around strengthening wealth. The main discrepancy is because “mothers are merely not connecting better with their adult pupils on the monetary subject areas,” said Isabel Barrow, director out of financial thought in the Edelman Economic Engines.